Agrim Fincap Private Limited (“Agrim” or “the Company”) is a Non-Banking Financial Company (NBFC), registered with the Reserve Bank of India (RBI) as a non-deposit taking, non-systemically important NBFC. The Company is primarily engaged in providing personal loans, MSME finance, and other financial services.

In line with the RBI guidelines on the Fair Practices Code for NBFCs, Agrim has adopted this Boardapproved policy, which outlines transparent practices to be followed while dealing with customers. This Code is designed to foster confidence, promote ethical conduct, and ensure fairness in all customer interactions.

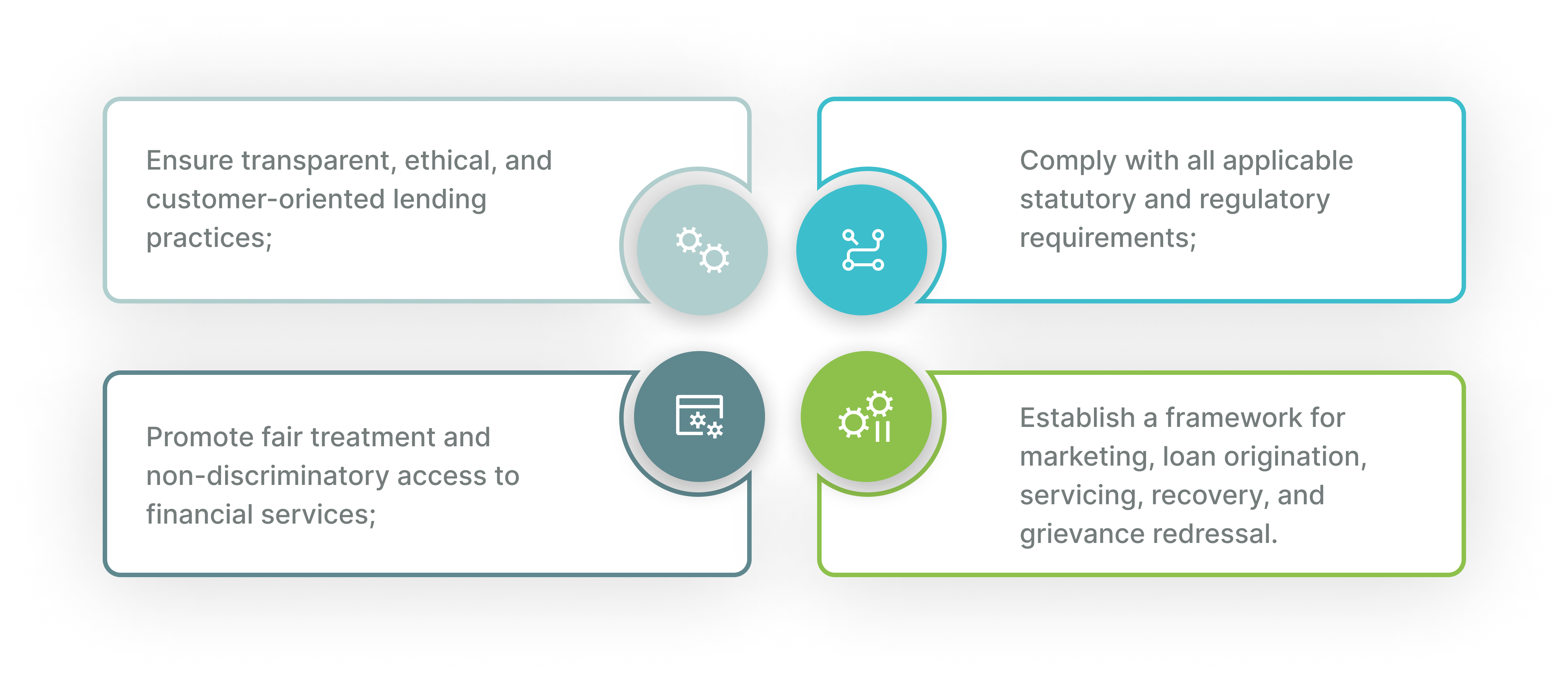

The purpose of this Fair Practices Code (FPC) is to:

Loan Appraisal and Terms/Conditions

Loan Disbursement and Changes in Terms

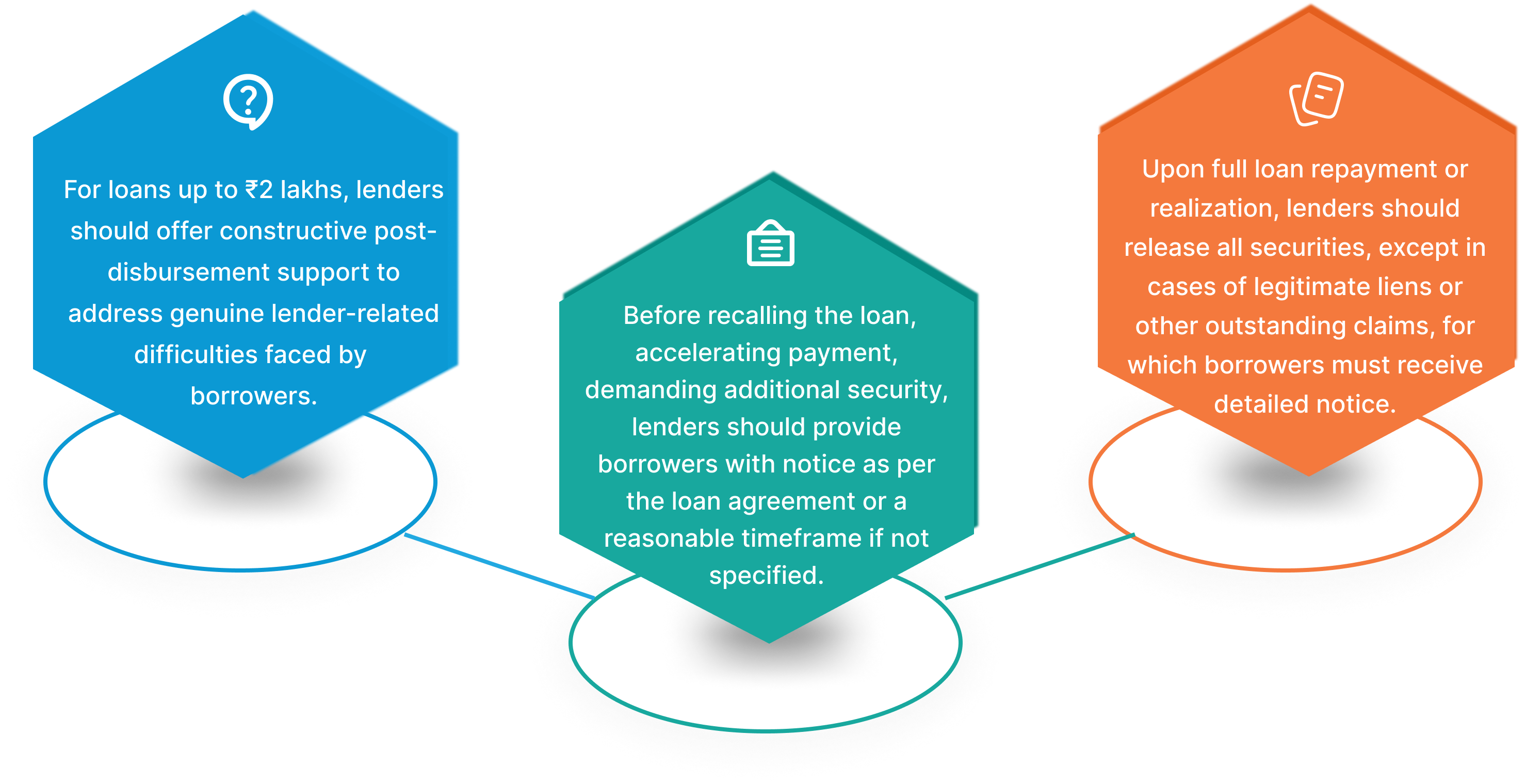

Post-Disbursement Monitoring

Confidentiality of Information

FAIR PRACTICE CODE FOR MICROFINANCE LOANS

a. General

- The FPC in vernacular language shall be displayed in its office and branch premises, as well as on the company's website.

- Train field staff to inquire about borrower income and existing debt.

- Any borrower training offered will be free.

- Display minimum, maximum, and average microfinance interest rates prominently in offices, vernacular literature, and on the website.

- The loan agreement and displayed FPC (office, branch, website) will declare the company's accountability for inappropriate employee (including outsourced) behaviour and commitment to timely grievance redressal.

- No security deposit or margin will be collected from borrowers.

- The company will use a standard microfinance loan agreement, preferably in the local language.

- All loan terms and conditions will be disclosed in the loan agreement.

- The loan card will clearly show: a simplified pricing factsheet, all loan terms, borrower identification, repayment acknowledgements (including final discharge), the grievance redressal system and nodal officer contact details.

- Non-credit products issued shall be with full consent of the borrowers and fee structure shall be communicated in the loan card itself.

- All entries in the loan card shall be in the vernacular language or the language as understood by the borrower.

GRIEVANCE REDRESSAL MECHANISM

Agrim shall establish a robust grievance redressal framework.

Key highlights include:

FORCE MAJEURE

In exceptional cases of Force Majeure (natural disasters, pandemics, war, regulatory actions, etc.), the commitments under this Code may not be fully enforceable. However, the Company shall make best efforts to fulfill its obligations under such conditions.

REVIEW

This FPC shall be reviewed annually or earlier if mandated by changes in RBI regulations. The Board will ensure the continued relevance and effectiveness of this Code through appropriate modifications from time to time.

DISCLAIMER

All content published on our platform is for general informational purposes. Agrim does not guarantee the accuracy or completeness of such content and disclaims liability for reliance placed upon it.

External websites linked from our platform are not endorsed or verified by us. Their policies may vary and users must exercise caution.