Personal Loans That Put You First

A personal loan from Agrim Fincap Private Limited offers immediate financial relief when you need it the most — without collateral, with minimal documentation, and in just a few minutes. Whether you are facing an emergency, an unplanned expense, or require short-term funds, our quick and transparent credit solution helps you bridge your need with ease.

Our personal loans are designed to be accessible, secure, and compliant with all applicable RBI guidelines. We support salaried individuals by offering fast, short-term loans that can be repaid on the next salary date — helping you stay financially confident.

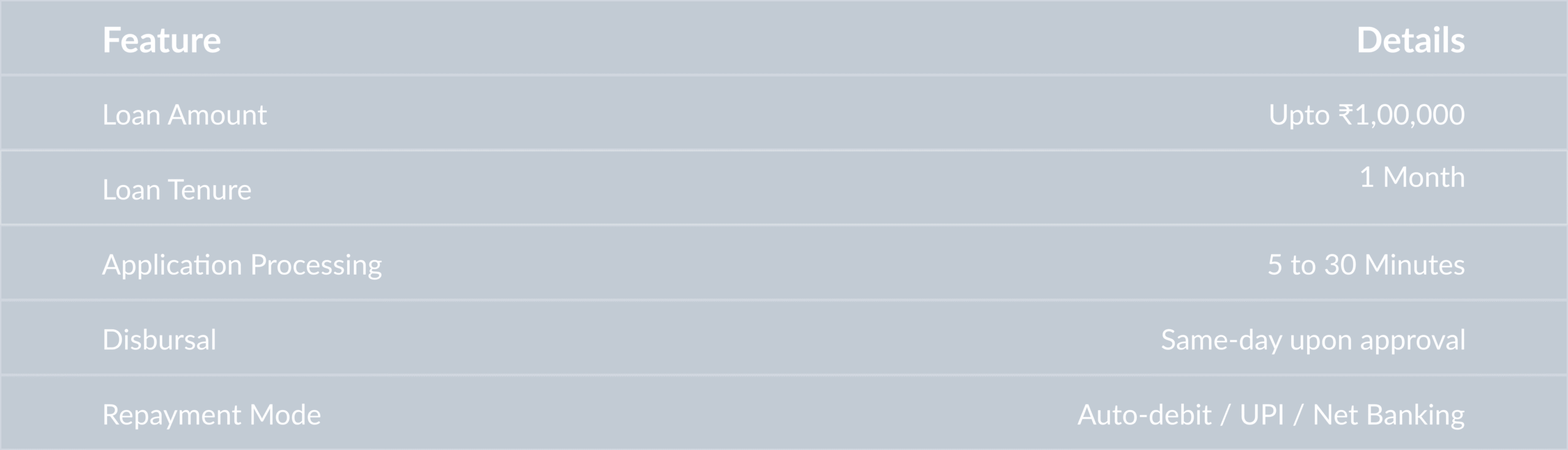

Key Loan Features at a Glance

Documents Required

-

PAN Card & Aadhaar Card (or equivalent government-issued ID)

PAN Card & Aadhaar Card (or equivalent government-issued ID) -

Latest 3 Months' Bank Statement

Latest 3 Months' Bank Statement -

Last 1 Months’ Salary Slips

Last 1 Months’ Salary Slips -

Mobile Number linked to Aadhaar

Mobile Number linked to Aadhaar

What You’ll Need to Apply

PAN Card & Aadhaar Card (or equivalent government-issued ID)

Latest 3

Months' Bank

Statement

Last 1

Months’

Salary Slips

PAN Card & Aadhaar Card (or equivalent government-issued ID)

Who Can Apply for a Loan?

Indian Citizen

Age: 21 years and above

Salaried employment in the private or government sector

Minimum monthly income: ₹35,000

Loan Summary

Why Choose Agrim?

RBI-Registered NBFC with responsible and ethical lending practices

Real-time eligibility check with instant decisions

Transparent pricing with no hidden fees

Dedicated support for post-loan servicing and queries

Disclaimer

A personal loan from Agrim Fincap Private Limited offers immediate financial relief when you need it the most — without collateral, with minimal documentation, and in just a few minutes. Whether you are facing an emergency, an unplanned expense, or require short-term funds, our quick and transparent credit solution helps you bridge your need with ease.